OCEANFRONT BLOG

Financial Planning Is Emotional… and That’s Okay

When people think about financial planning, they often picture spreadsheets, investment returns, and tax strategies. But what we’ve learned at OceanFront Wealth—time and time again—is that true financial planning starts somewhere much deeper.

It starts with emotion.

Whether it’s the stress of rising living costs, the fear of making a wrong move, or the guilt of not having started sooner, money touches some of the most vulnerable parts of our lives. And that’s okay.

We see it in our conversations with clients every day. A successful business owner who feels uneasy about stepping away from their company. A couple wondering if they’ve done enough to support their children. A recent widow unsure of what comes next. These aren’t just financial situations, they’re human ones.

And when we allow space for the emotional side of money, something powerful happens, clarity begins to form.

The Financial Stress Index Says It All

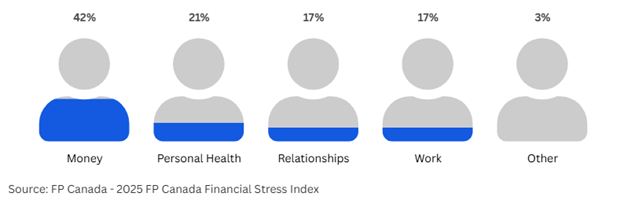

According to FP Canada’s 2025 Financial Stress Index, money remains the number one source of stress for Canadians—ranking ahead of work, relationships, and personal health. Even more telling, many Canadians cite fear, anxiety, and simply being overwhelmed as the biggest barriers to taking control of their finances.

But the research also points to something hopeful: Canadians who work with financial professionals report less stress, more sleep, and greater optimism about their future. That’s not because planners have magic answers. It’s because they create structure, offer guidance, and most importantly—listen.

At OceanFront, We Start with What Matters Most

Before we ever talk numbers, we ask questions. What does peace of mind look like for you? What values do you want to pass on to your children? What’s the one decision you’ve been putting off?

We believe financial planning is about helping you live a life that reflects what’s truly important not just in retirement, but right now.

By acknowledging the emotional weight money can carry, we’re better able to help clients build plans that are resilient, meaningful, and aligned with their values.

It’s Okay to Feel Something When Talking About Money

Financial planning isn’t about pretending emotions don’t exist, it’s about creating a space where they can be understood, respected, and used as a foundation for good decisions.

So, if you’ve ever felt embarrassed, anxious, or even stuck when thinking about your finances, know this:

You’re not alone. You’re not behind. And it’s okay to feel what you feel.

We’re here to walk with you, not just to manage your wealth but help you live a life of intention and purpose.

At OceanFront[1], we’re here to help! Contact us today for more information on financial planning.